Guided Wealth Management - The Facts

Table of ContentsUnknown Facts About Guided Wealth ManagementGetting My Guided Wealth Management To WorkGuided Wealth Management Fundamentals ExplainedGuided Wealth Management Things To Know Before You Get ThisThe Basic Principles Of Guided Wealth Management

For investments, make settlements payable to the item supplier (not your advisor). Offering a financial advisor full accessibility to your account increases risk.If you're paying a continuous suggestions cost, your adviser needs to review your monetary circumstance and meet you at the very least when a year. At this conference, make certain you review: any type of modifications to your goals, circumstance or finances (including adjustments to your revenue, expenses or properties) whether the degree of risk you're comfortable with has actually transformed whether your present individual insurance coverage cover is appropriate just how you're tracking against your goals whether any type of modifications to regulations or monetary items might affect you whether you have actually gotten whatever they guaranteed in your contract with them whether you require any kind of adjustments to your plan Annually an adviser need to seek your written grant bill you continuous advice charges.

If you're relocating to a new adviser, you'll need to set up to transfer your financial records to them. If you need assistance, ask your adviser to clarify the process.

The 6-Minute Rule for Guided Wealth Management

As a business owner or local business owner, you have a whole lot taking place. There are many obligations and expenditures in running an organization and you absolutely do not need another unnecessary costs to pay. You require to very carefully think about the roi of any kind of solutions you get to ensure they are rewarding to you and your company.

If you are among them, you might be taking a huge threat for the future of your service and on your own. You may wish to check out on for a list of factors why employing a monetary advisor is useful to you and your service. Running a company has lots of obstacles.

Money mismanagement, money circulation troubles, overdue settlements, tax obligation problems and various other monetary troubles can be critical adequate to shut a business down. That's why it's so essential to manage the financial elements of your service. Hiring a reliable economic advisor can stop your organization from going under. There are several manner ins which a certified monetary consultant can be your companion in helping your service grow.

They can deal with you in examining your financial situation on a regular basis to stop serious mistakes and to quickly correct any type of negative money decisions. A lot of local business proprietors use several hats. It's reasonable that you intend to save money by doing some work on your own, however managing funds takes expertise and training.

Getting The Guided Wealth Management To Work

Preparation A organization strategy is important to the success of your company. You require it to recognize where you're going, just how you're arriving, and what to do if there are bumps in the road. A great economic expert can put with each other a comprehensive strategy to assist you run your service more effectively and prepare for anomalies that emerge.

Wise financial investments are critical to accomplishing these objectives. Many company owner either don't have the know-how or the moment (or both) to analyze and evaluate investment chances. A trusted and experienced monetary advisor can lead you on the investments that are appropriate for your service. Money Cost savings Although you'll be paying an economic expert, the lasting cost savings will certainly justify the expense.

It's everything about making the wisest economic choices to raise your chances of success. They can lead you towards the very best opportunities to enhance your revenues. Decreased Stress and anxiety As an entrepreneur, you have this article lots of things to stress around (financial advisor brisbane). A good financial advisor can bring you satisfaction understanding that your funds are obtaining the interest they need and your cash is being invested sensibly.

Everything about Guided Wealth Management

Stability and Development A qualified economic consultant can offer you quality and help you focus on taking your organization in the ideal direction. They have the tools and resources to utilize strategies that will guarantee your organization grows and prospers. They can aid you analyze your objectives and determine the ideal course to reach them.

The Facts About Guided Wealth Management Uncovered

At Nolan Accounting Facility, we offer experience in all aspects of monetary planning for tiny companies. As a local business ourselves, we know the obstacles you face on a day-to-day basis. Provide us a phone call today to review how we can assist your service prosper and prosper.

Independent ownership of the method Independent control of the AFSL; and Independent remuneration, from the customer only, using a fixed buck cost. (https://papaly.com/categories/share?id=452b670cd6c24692884499b7ec0f1197)

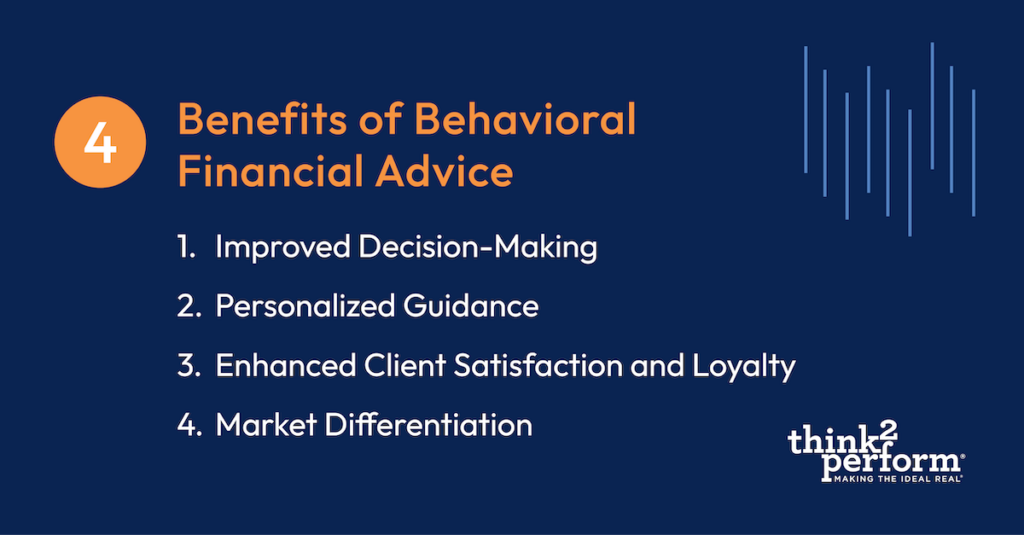

There are many advantages of a financial coordinator, no matter of your scenario. Yet regardless of this it's not unusual for people to 2nd guess their suitability due to their position or current financial investments. The aim of this blog site is to show why everybody can gain from a monetary plan. Some common worries you may have felt on your own consist of: Whilst it is easy to see why people may believe by doing this, it is certainly wrong to deem them fix.